If the equal monthly payment plan (Instalment Interest Free Promotion) is for a term less than 33 months, the minimum monthly payment will be greater than an interest free payment for the same term and you may pay more interest on any other outstanding balance on your credit card account, as your repayments will be allocated to this plan first.

Payable in 6, 12, 24, 50 or 60 equal monthly payments (exact amounts specified in your statement). #Equal monthly payment plans (promotional period only) Paying only the minimum monthly payment will not pay out the purchase before the end of the plan. Interest and payments are payable after the interest free period expires. Whilst the monthly payments may be lower, you could pay more overall, as interest is calculated over a longer term.Minimum monthly payments must be made during the promotional period. As a general rule, the longer the repayment term, the lower the monthly payments will be, as the amount financed is spread over a longer period.

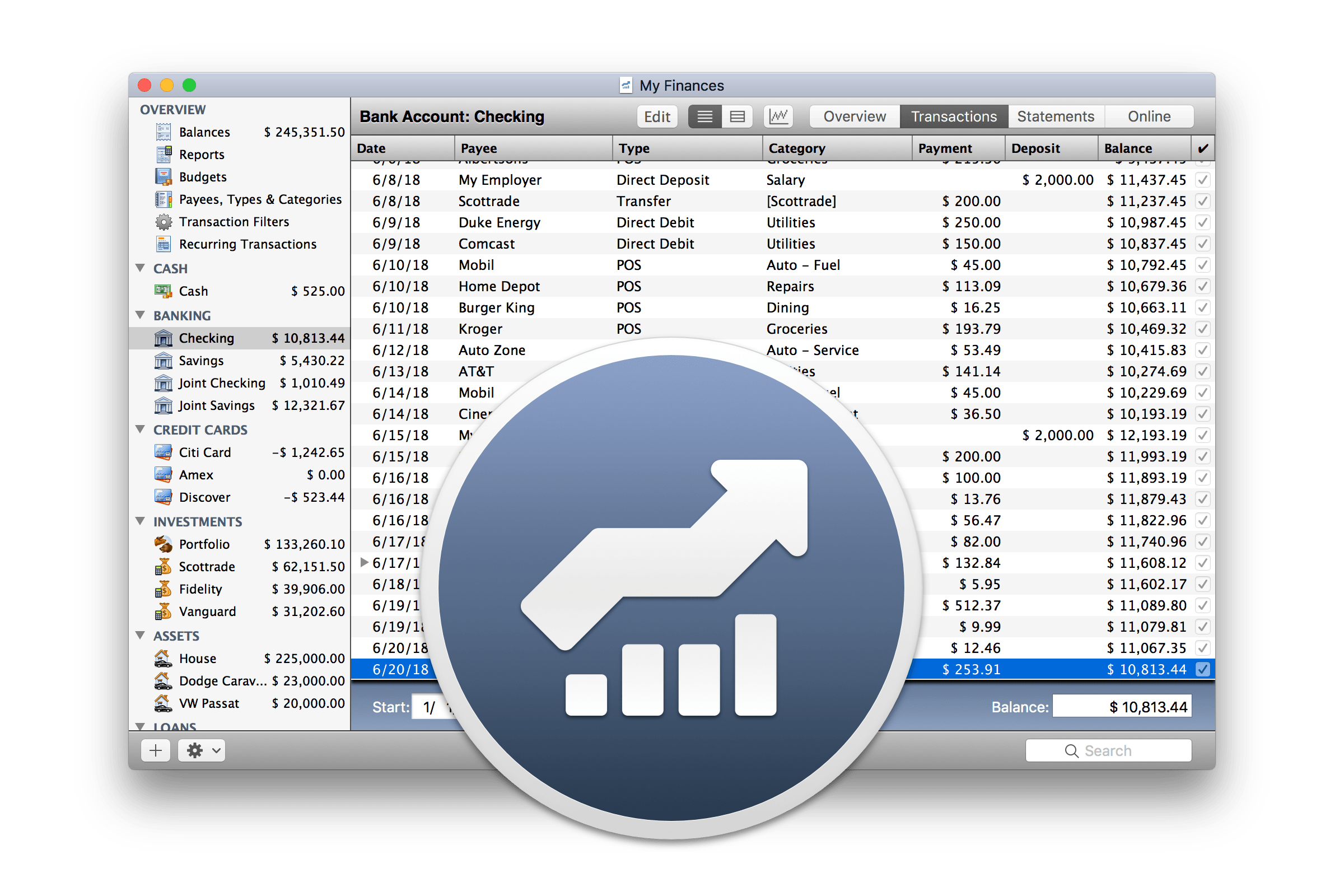

Free version of see finance 2 upgrade#

There are a variety of things to consider when you are choosing the right option for you: What can you afford to pay monthly? Are you likely to have any major outgoings over the next few years that might affect how long you’d like to pay for a car on finance? Are you likely to be in paid employment throughout the duration of the contract? At what point will it be cost effective or desirable to upgrade to a new model? What’s your expected annual mileage? This can affect vehicle depreciation and the value at the end of the contract, as well as your monthly payments. Your finance term is the period over which you’ll spread your repayments, which for most people tends to be between 2 and 4 years. Take a look at our PCP, HP and CH pages for more information on each.ĭeciding the length of your plan is dependent upon lots of different factors. They’re not the only plans available, but they are often compared when car buyers are making a decision about finance. Personal Contract Purchase (PCP), Hire Purchase (HP) and Contract Hire (CH) are some of the more popular types of car finance agreement. You’ll need to get some key pieces of information in place before you know which type of agreement will suit you, such as what monthly payment you can afford, how much deposit you can put in up front, how likely it is that your circumstances might change, and whether or not you want the option to own the vehicle at the end of the agreement. If you’re in the market for a new car, you might be starting to research which finance option is best for you.

Contract Hire is available for both Personal and Business use.

Simply return it to Audi Financial Services and pay any damage or mileage charges that may apply. At the end of the agreement, you do not own the car. Contract Hire (CH) is a simple leasing agreement with fixed monthly rentals. If you want a newer model, you can use any equity to part-exchange your current model for a new one. At the end of your agreement, simply pay the option to purchase fee and own the car. The amount financed is spread equally across your selected repayment term. Hire Purchase (HP) is a straightforward route to car ownership. You can buy the car outright (once all outstanding fees and charges are settled), return the vehicle to Audi Financial Services (subject to excess mileage and damage charges), or use any equity in the car to trade it in as a deposit for a newer model. Solutions Personal Contract Plan (PCP) is a flexible plan that gives you multiple options at the end of the agreement.

0 kommentar(er)

0 kommentar(er)